Factors that caused the growth of the Pakistani startup ecosystem in 2021

2021 was the best year on record for Pakistani startups with $375 million raised (a 450% increase from 2020) across 82 deals. With blockbuster deals such as Bazaar’s $36.5 million Series A raise and Airlift’s huge $85 million Series B round (the largest in the history of Pakistani startups), has put Pakistan as an opportunity and ecosystem on show.

A number of factors have played a role in growing the ecosystem; the market opportunity, trust in the Pakistani ecosystem, government promotion of startups, and the influx of talent in Pakistan.

The Market Opportunity

Pakistan is a country of approximately 220 million people making it the 5th most populous country in the world. The top 4 most populous countries (China, India, the United States of America, and Indonesia) have far more developed startup ecosystems which leaves Pakistan as an attractive proposition to prospective investors given the potential scale of growth and the enticement of getting into a country at its ecosystem’s infancy. Investors both locally and internationally have realized that Pakistan is ready for business.

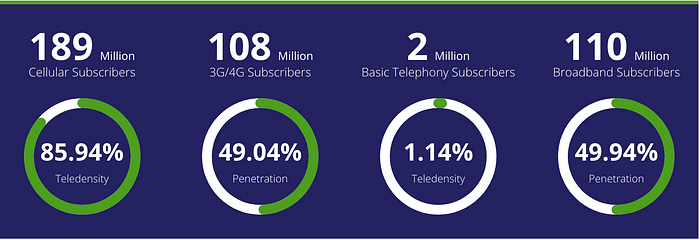

Another factor that has allowed startups to grow at an exponential rate in Pakistan is the increased smartphone and internet adoption in the country. According to the Pakistan Telecommunication Authority, Pakistan has 189 million cellular subscribers and 108 million 3G/4G subscribers. This increased penetration of internet users allowed startups in 2021 of reaching a wider audience of consumers as well as allowing more consumers access to applications that were beneficial to them. Furthermore, social media has played a big part in the way startups could market to consumers and how consumers could learn about startups. According to Data Reportal, from January 2020 to January 2021, there was an increase of 9 million social media users in Pakistan (a 24% increase).

Increased Trust in the Ecosystem

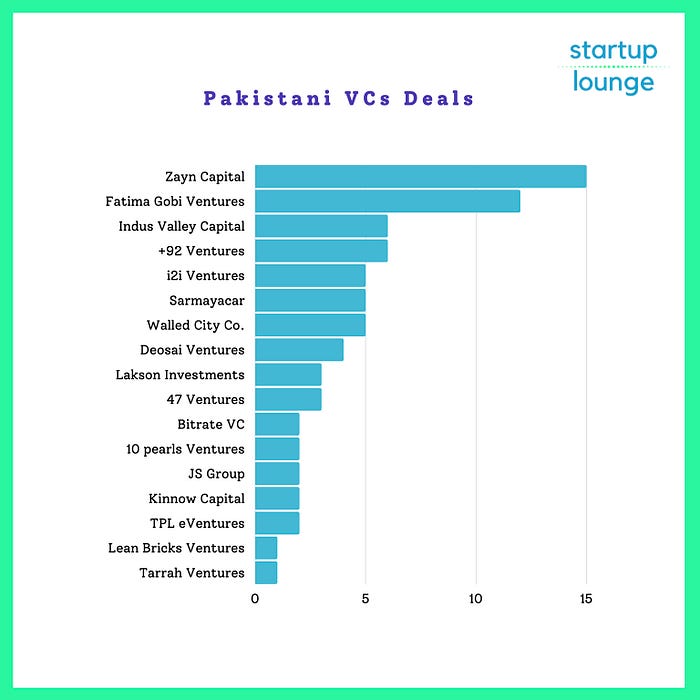

A problem that has typically plagued Pakistan is trust in the system, particularly when looking at international investors looking to invest. Investors want to know that their investments will be safe. Pakistan in the year 2021 has really combatted this issue by having local venture capitalists with good international reputations leading investment rounds. Funds like Zayn Capital and Fatima Gobi Ventures have changed the way local VCs operate by applying a much more formal and professional structure to investment deals. This in turn gives trust to the ecosystem where foreign funds feel a certain level of confidence in investing and co-investing in Pakistani startups. Moreover, the influx of new local VCs has led to increased capital being available to startup founders in order to grow their businesses.

Big name international VC funds investing in Pakistan has given a larger media spotlight to the country as well as providing a level of validation to the startups that are in operation. In 2021 we saw companies like Tiger Global, First Minute Capital, Sturgeon Capital, and Antler make investments into Pakistani based startups (to name but a few). In addition to providing more funding to startups, having large international funds lends credibility to the system building process. Belief is a key indicator into any startup ecosystem and the Pakistani ecosystem has grown thanks to the domino effect of more investors seeing the value that can be created in the country.

Government Involvement

The government of Pakistan has been promoting entrepreneurship in a number of ways. The most significant being the removal of red tape surrounding the entrepreneurship process. Pakistan has recognized the importance of digital banking in the pursuit of financial inclusion and with that end has granted more digital banking licenses. Government schemes such as Startup Punjab have encouraged younger entrepreneurs to pursue entrepreneurship as a career path. Also, the government has been able to provide loans and funding to some startups. In January of 2022, the Prime Minister (Imran Khan) said that Pakistan needs to model its ecosystem on Silicon Valley and create a startup friendly environment. Additionally, he stated that, “we are giving SMEs bank credit facility, land for their businesses on lease and [are committed to] eradicating red tapism.”

Influx of Talent

The opportunity in Pakistan has seen young Pakistani entrepreneurs, who have gained experience abroad, coming back to Pakistan to found startups. Using their gained knowledge to help them navigate the sometimes-unstable entrepreneurial roads. Startups such as Bazaar and Airlift have co-founders who have returned to take advantage of the incredible opportunity that Pakistan presents. Having founders with these experiences is a boost to the whole ecosystem as they can take the lessons that they learned and act as a reference point to other founders and joiners.

Another development has been high quality local university graduates who are joining Pakistani startups. Universities like NUST and LUMS are providing further training to their students to be able to be assets in Pakistani startups. Also, we are in the process of seeing many fresh university graduates entering the startup space and foregoing traditional employment paths. Programs such as Venture for Pakistan have facilitated the process of exposing university students to the startup world by pairing students with startups for internships and job opportunities.

Conclusion

In conclusion, although Pakistan is still considered an untapped opportunity as compared to its global peers, the massive growth seen in 2021 has shown that it is on the right track to becoming one of the major startup ecosystems in the world. Pakistani startups had a great 2021 and there is no reason why they can’t have an even better 2022.